rabbit - case study

Simple money, same-day answers

financial services

Project Inputs

User journey mapping & UX strategy, Visual/UI design, User research, Competitors analysis, Wireframes & high-fidelity prototypes, usability testing & iterative refinement.

Industry

Fintech

Context & Goal

We designed credit for the people who keep the neighborhood running:

Corner-store owners with little time, old phones, and cash-first habits. The brief was not “more forms”—it was: ask for a loan without leaving the counter, get a clear yes/no in minutes, and know exactly how you’ll repay.

We built two friendly fronts to the same engine: a mobile app for those who prefer screens, and a WhatsApp flow for those who prefer conversations.

Both share the same promise—plain language, progressive KYC, instant status, and receipts you can show to anyone.

We built two friendly fronts to the same engine: a mobile app for those who prefer screens, and a WhatsApp flow for those who prefer conversations.

Both share the same promise—plain language, progressive KYC, instant status, and receipts you can show to anyone.

Same engine, two doors:

App for taps, WhatsApp for chat

Both built for speed, clarity, and trust.

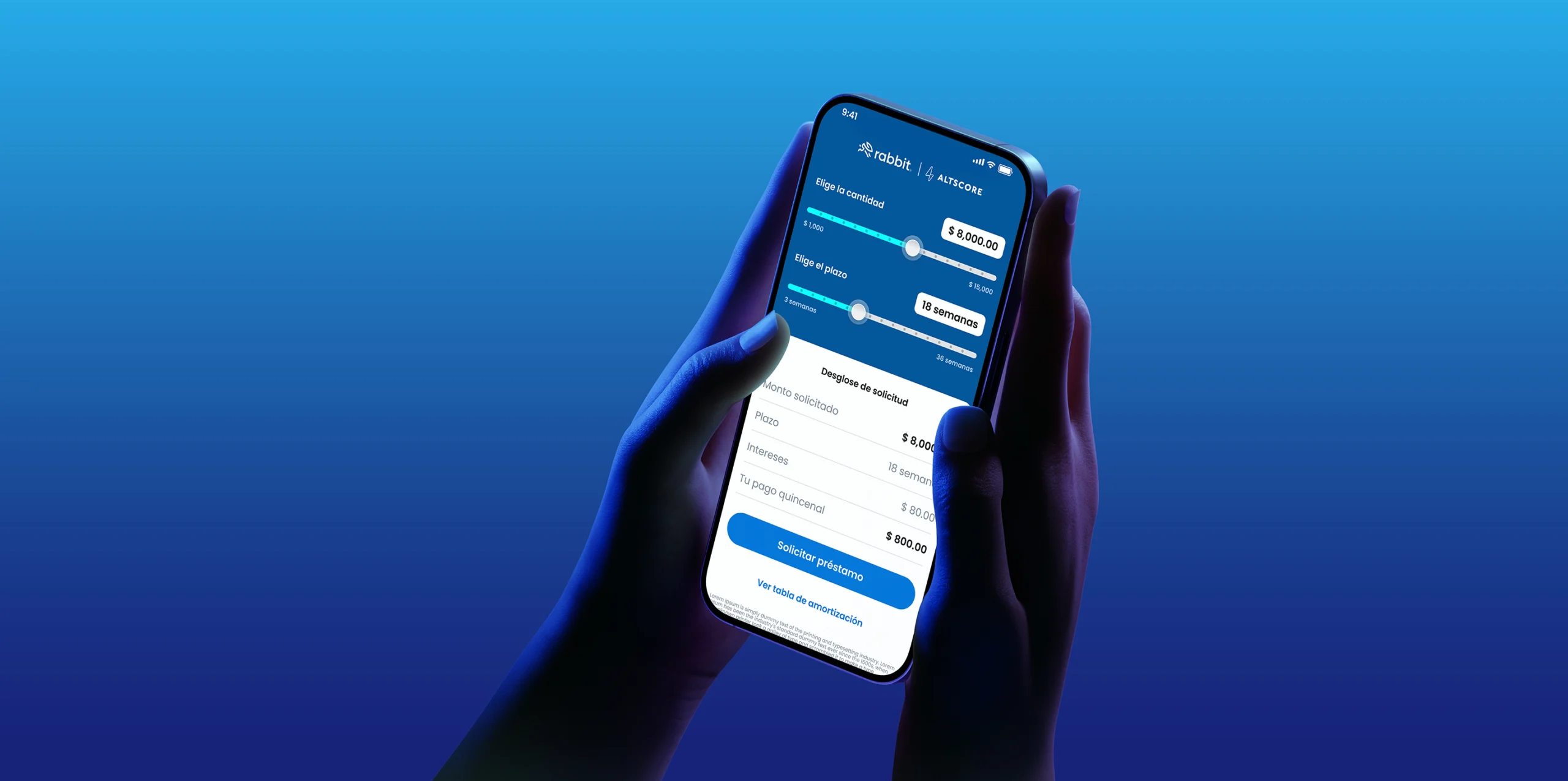

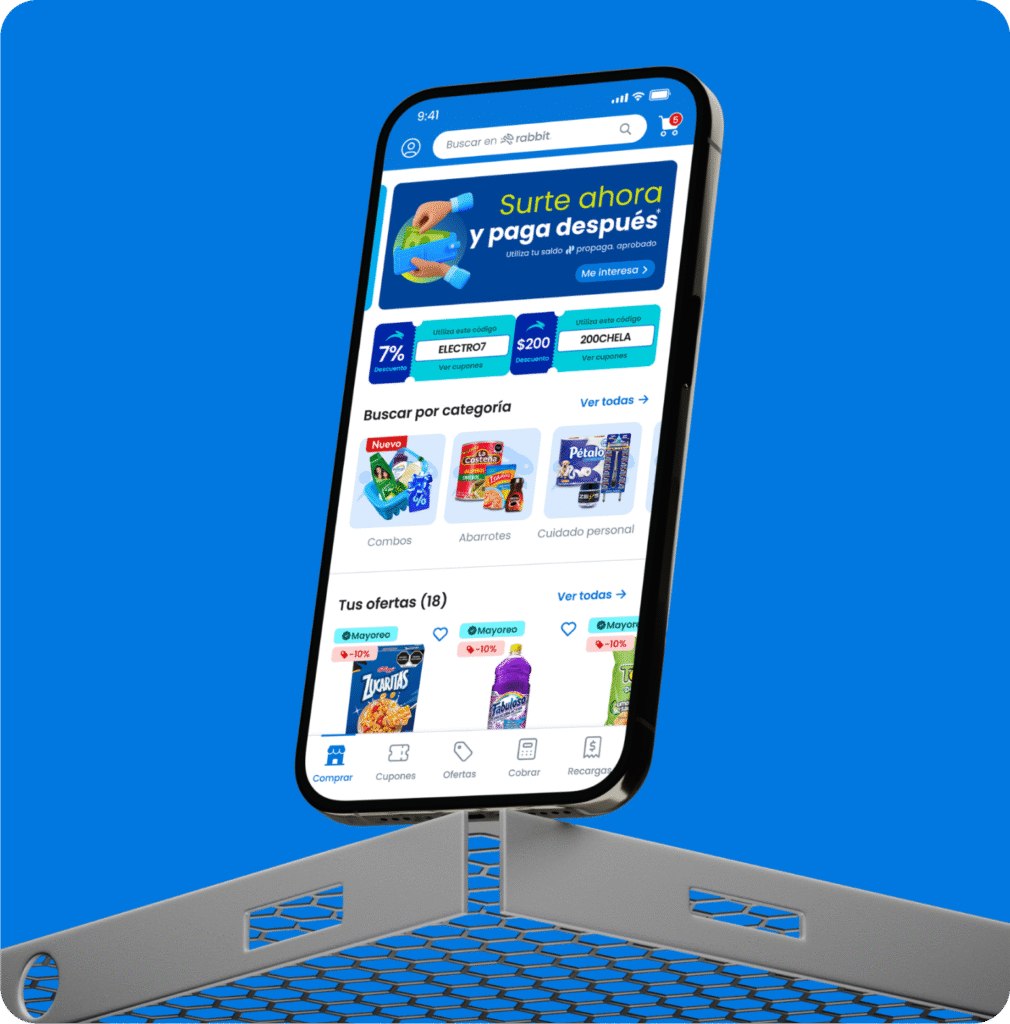

Core Features — Mobile App

Tap-to-Apply (Progressive KYC)

Face + ID + store details in small steps with real-time checks; decision shown on the spot.

Instant Decisioning

Risk rules + data signals (store activity, payments history) return approved / review / declined with a clear reason.

Clear Offers & Repayment

Amount, term, fee, APR, and total-to-pay shown upfront; slider to preview installments before you confirm.

Disbursement Your Way

Send to the Rabbit account, linked bank, or cash-out partner; funds availability shown with ETA.

Smart Reminders & Autopay

WhatsApp/app nudges before due dates; optional automatic payments; no-surprise late fee policy.

Receipts & Statements

Shareable confirmation after each step—application, funding, installment paid—plus one-tap monthly statements.

Store-Friendly Home

Today’s balance, next payment, and quick actions (Pay installment, Request another loan, Talk to support).

Designed for busy hands:

Clear, fast, zero guesswork

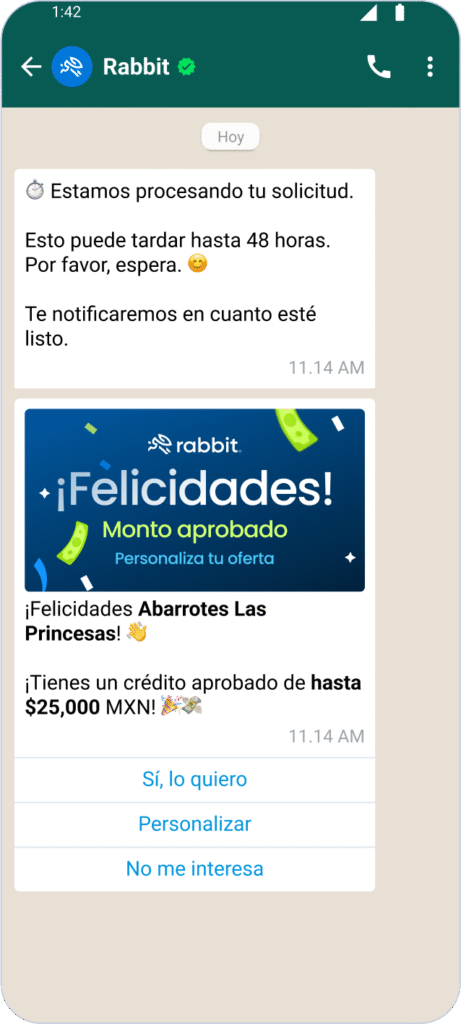

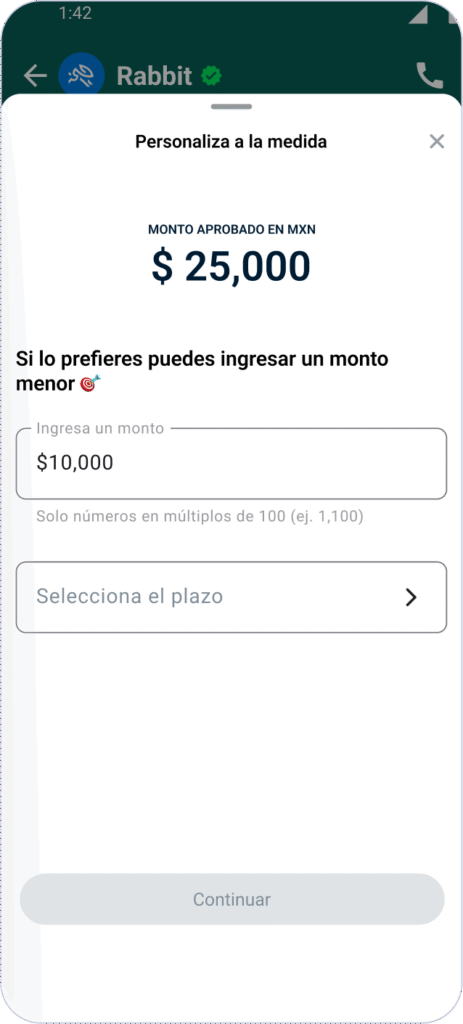

Core Features — WhatsApp Flow

Conversational Onboarding

“Hi, I want a loan” kicks off a guided chat: capture INE/passport, selfie, and store basics with tips and re-tries.

Quick Decision in Chat

We return the decision inside WhatsApp, with the same offer breakdown and a “Confirm” button.

One-Tap Documents and Proof

PDFs/receipts delivered in the thread; you can forward them to a partner or print later.

Payment and Reminders by WhatsApp

“Pay now,” “See my next due date,” “Change payment method,” all through menu buttons or quick replies.

marketplace

Smart restocking for the corner store

retail and Rewards

Your trusted network that turns prices into opportunities