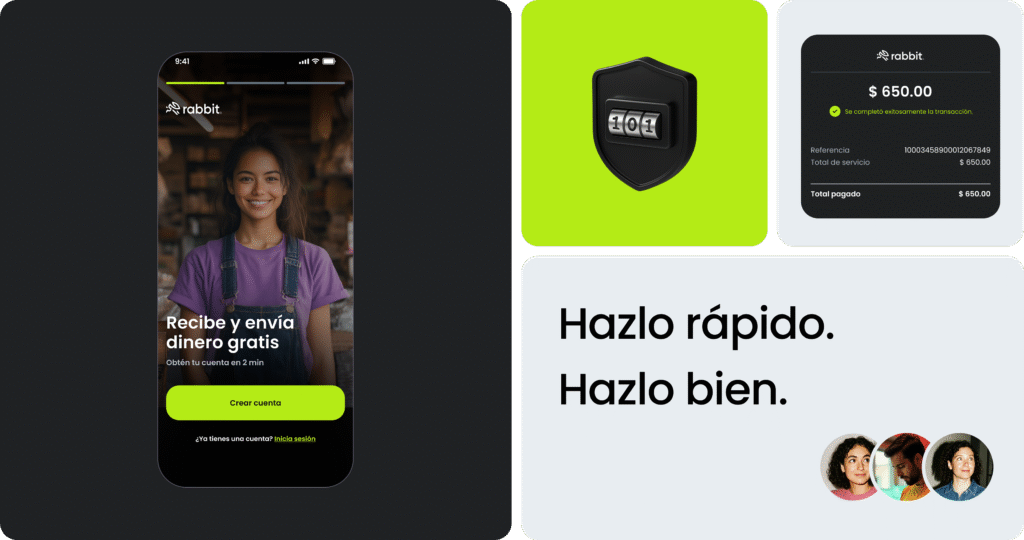

digital account - MVP*

Your first step to smarter money

digital account*

Project Inputs

UX strategy, Visual/UI design, User research, Competitors analysis, Wireframes & high-fidelity prototypes, usability testing & iterative refinement.

Industry

FinTech, Digital Banking, Payments & Money Transfer

*Conceptual project in development. The images shown are part of the UX/UI design process and do not represent a financial app currently in operation.

*Conceptual project in development. The images shown are part of the UX/UI design process and do not represent a financial app currently in operation.

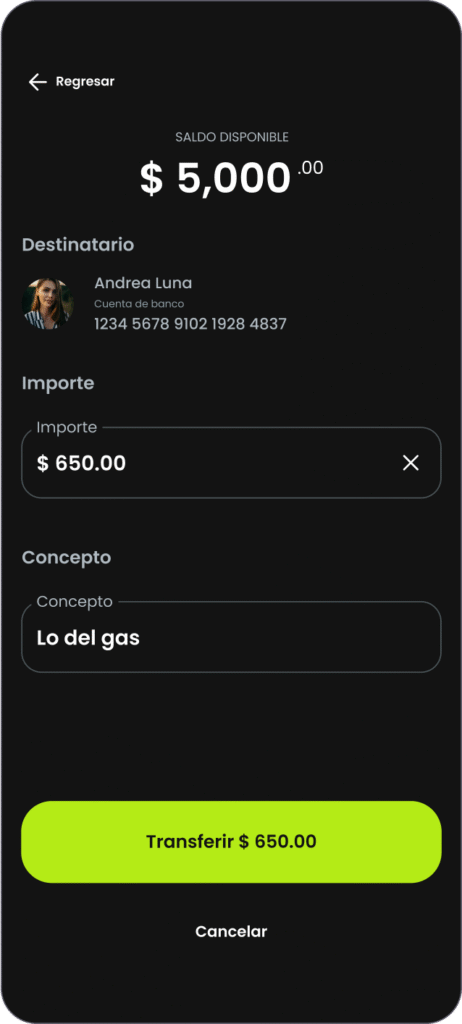

Pay, transfer, and recharge in one app.

We set out to give people a safe, intuitive place to manage money from their phone. Whether it’s freelancers, small business owners, or anyone looking for simple tools on any device, the goal is the same: the first five minutes feel clear, useful, and worth returning to.

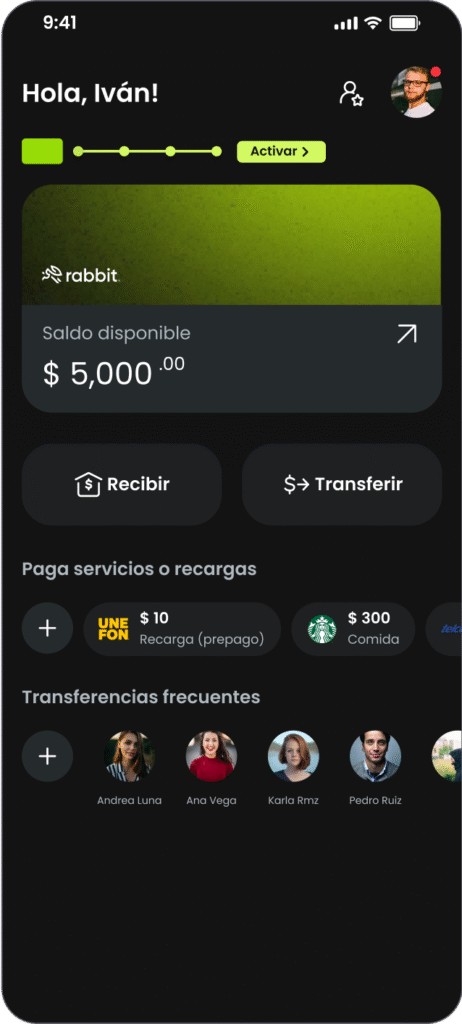

MVP

Only the essentials: open app, scan ID, confirm address, see balance, make a payment. One decision per screen, big buttons, plain words, fees upfront. Home shows the top three actions: pay services, send money, recharge. Card is optional, on demand.

What we’re testing

• Open an account in <5 minutes

• Configure their profile in the first session

• Request their physical card within the first week

From Blank Canvas to Bank in Your Pocket

UX Principles That Guided Every Screen

We ground iteration in heuristics and UX laws to turn guesswork into measurable wins. Together, these principles reduce cognitive load, speed tasks, and lift conversion without adding complexity.

3-Step Signup (Progressive KYC)

Face + ID + address in small, guided steps with clear progress and plain consent. Reduces cognitive load (Hick’s/Miller’s) and anxiety; aims for <5-minute open.

Home Built for Action

Balance up top and three primary actions (Pay services, Send money, Recharge). Large targets (Fitts’s), familiar patterns (Jakob’s) to speed first success.

Pay and Top-Up Hub with Favorites

Bills and airtime in one place, recent/favorite merchants first, totals and fees upfront. Cuts surprise, builds weekly habit, lowers abandonment.

Instant Receipts and Monthly Statements

Real-time success states, shareable receipts, and one-tap statement downloads. Matches real-world needs, reduces “did it go through?” support.

Security and Recovery by Design

Liveness + face match, device binding, step-up auth for risky moves; offline/low-signal resume to avoid duplicates. Clear error prevention and safe retries keep trust high.

As little design as possible,

As much value as necessary

will be revisited after first data

Directional targets to align the team pre-launch

MVP Success Targets

• 70–80% of sign-ups complete KYC and fund the account within Day 0.

• 35–45% 30-day retention driven by essential payments (bills/top-ups/transfers).

• Fraud losses <0.15% of processed volume; dispute rate <0.3%.

• CAC payback <6 months; blended take-rate ≥0.8–1.2% on payments/top-ups.

• 99.9% core uptime; <2% support tickets per 100 active users.

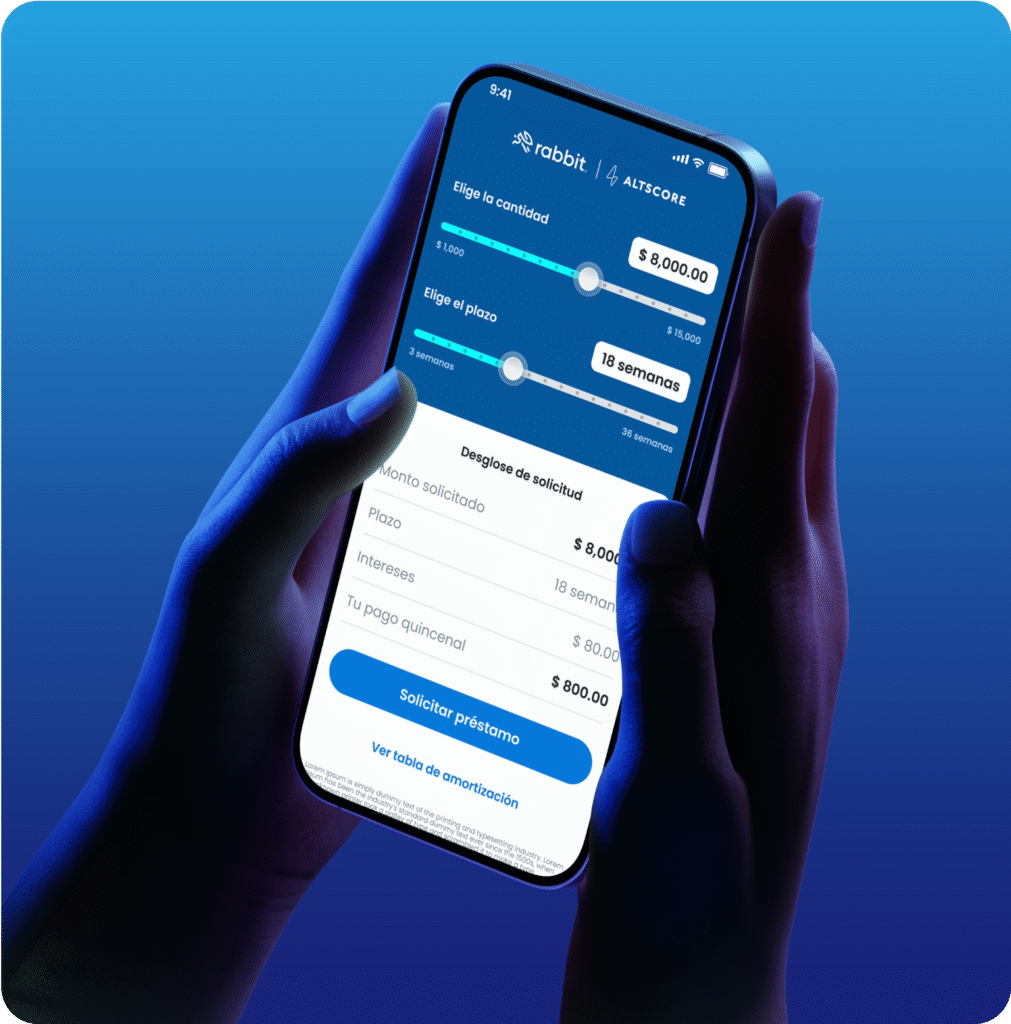

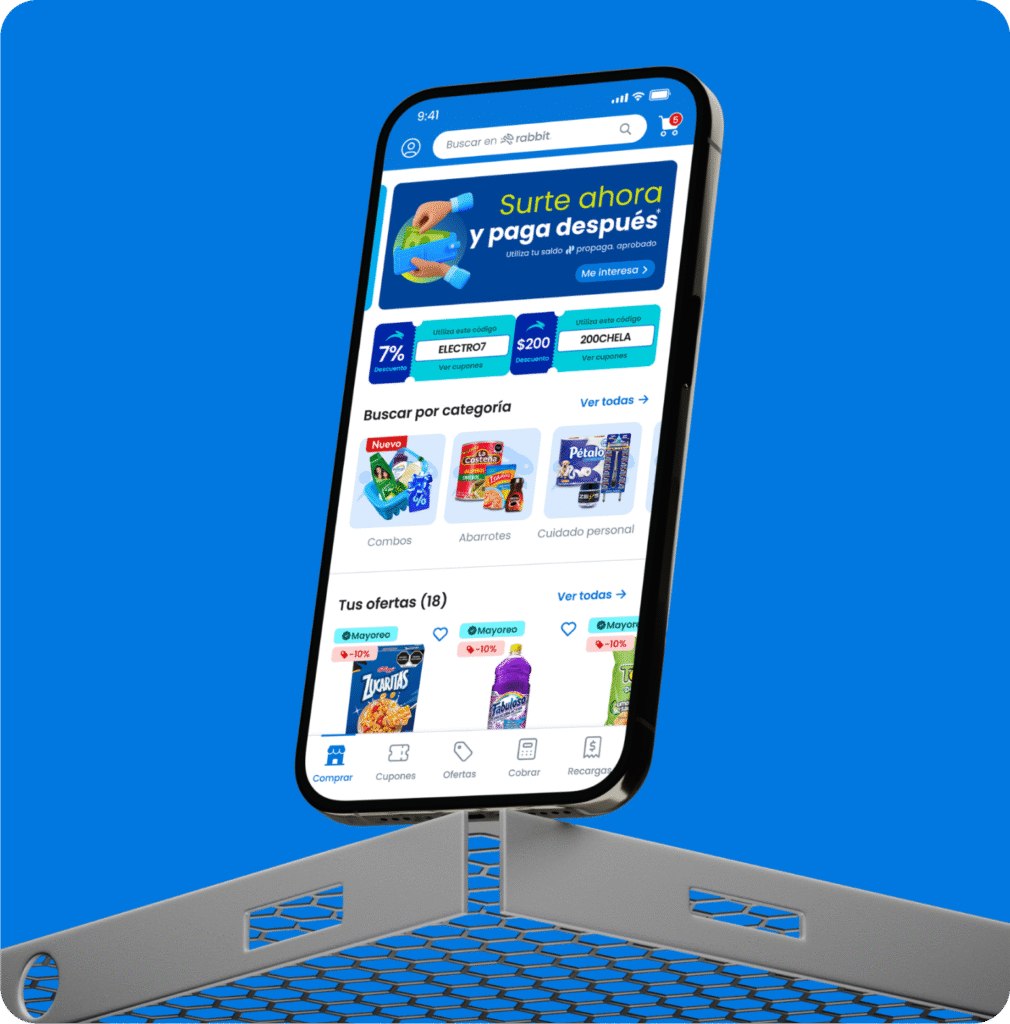

marketplace

Smart restocking for the corner store